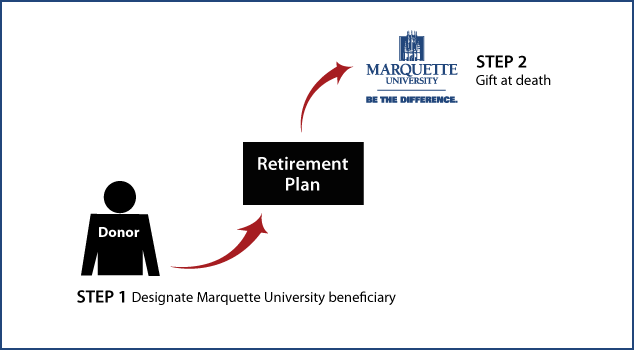

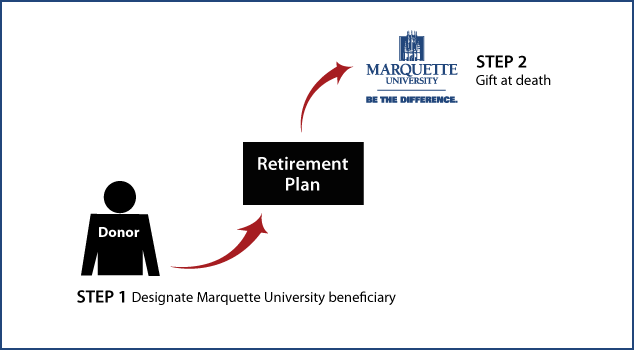

Gifts from Retirement Plans at Death

How It Works

- You name Marquette as beneficiary for part or all of your retirement-plan benefits

- Funds are transferred by plan administrator at your death

Benefits

- No federal income tax is due on the funds that pass to Marquette

- No federal estate tax on the funds

- You make a significant gift for the programs you support at Marquette

Special note: Call or e-mail us to tell us of your intent, and we will assist you with the details of the transfer.

More Information

Which Gift Is Right for You?

Back

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer